China has announced the lifting of export controls on computer chips crucial to automobile production, according to a statement released by the country’s commerce ministry on Sunday.

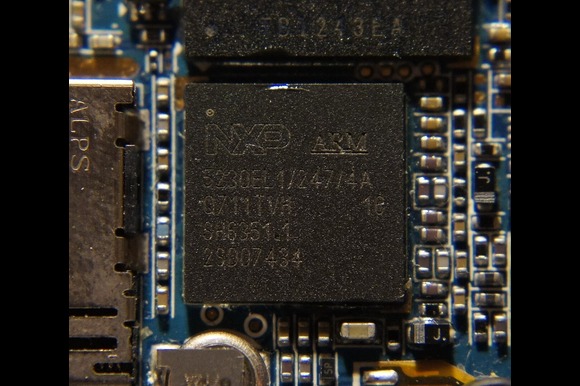

The decision grants exemptions for exports made by Chinese-owned semiconductor firm Nexperia, provided the chips are used for civilian purposes. The move is expected to ease concerns among car manufacturers in Europe who feared production delays due to shortages of vital components.

At the same time, Beijing has temporarily paused an export ban to the United States on several materials essential to the semiconductor sector and suspended port fees for American vessels, signalling a softening of trade tensions between the world’s two largest economies.

Step Toward Calmer US-China Trade Relations

The easing of restrictions comes shortly after President Xi Jinping and US President Donald Trump reached an agreement in October to reduce tariffs on each other’s goods and pause additional measures for one year.

In October, the Dutch government had assumed control of Nexperia—a semiconductor company based in the Netherlands but owned by Chinese electronics manufacturer Wingtech—to protect Europe’s supply of chips for the automotive and technology industries.

Beijing responded by blocking exports of Nexperia’s finished chips, escalating tensions between China and Europe. However, earlier this month, Chinese authorities confirmed that the restrictions would gradually be relaxed as part of a wider trade deal negotiated with Washington.

European Carmakers Warned of Looming Supply Crisis

Although Nexperia operates from the Netherlands, around 70% of the chips produced in Europe are sent to China for final processing before being re-exported worldwide.

The Dutch government said its decision to take control of the company was prompted by “serious governance shortcomings” and to ensure that semiconductor supplies would remain accessible during emergencies.

However, China’s export block triggered widespread concern over possible global supply chain disruptions. In October, the European Automobile Manufacturers’ Association (EMEA) warned that supplies of Nexperia chips could run out within weeks if the ban continued.

EMEA Director General Sigrid De Vries told the BBC earlier this month that “supply shortages were imminent,” while carmakers such as Volvo Cars, Volkswagen, and Jaguar Land Rover cautioned that the chip shortfall could lead to temporary factory shutdowns and threaten business continuity.

EU Welcomes “Simplified” Export Procedures

On Saturday, EU Trade Commissioner Maros Sefcovic confirmed via a post on social media platform X (formerly Twitter) that China had agreed to “further simplify export procedures for Nexperia chips.”

He added that the country would “grant exemption from licensing requirements to any exporter” as long as the goods were intended for civilian use.

“Close engagement with both the Chinese and Dutch authorities continues as we work towards a lasting, stable, and predictable framework that ensures the full restoration of semiconductor flows,” Sefcovic said.

In its accompanying statement, China’s commerce ministry urged the European Union to “continue exerting its influence to encourage the Netherlands to correct its erroneous practices as soon as possible.”

Analysts Say China’s Move a “Wake-Up Call”

According to Professor David Bailey of Birmingham University’s Business School, China’s retaliatory actions served as a “wake-up call” for the global automotive industry.

“The Dutch government may well have had good reasons for taking control of Nexperia, but it hadn’t fully considered the consequences,” he said in an interview with the BBC’s Today programme. “The retaliation from China was swift and brutal.”

Bailey added that manufacturers should now focus on diversifying chip processing sites—potentially in Southeast Asia or Europe—and maintaining larger inventory reserves to mitigate future disruptions.

Temporary Suspension of Material Export Bans and Port Fees

Meanwhile, China has suspended a ban on exports of “dual-use items”—materials that can serve both civilian and military purposes—such as gallium, germanium, antimony, and other super-hard substances used in chipmaking.

The suspension took effect on Sunday and will remain valid until 27 November 2026. The original ban on these materials had been announced in December 2024.

Additionally, China’s transport ministry confirmed that port fees for US-linked ships will be waived for one year, effective 05:01 GMT on Monday.

Just two days earlier, on Friday, Beijing also declared the suspension of export controls on certain rare earth elements and lithium batteries, which are crucial for electric vehicles and renewable energy technologies.

Outlook: A Fragile but Positive Step Forward

China’s decision to ease restrictions on semiconductor exports and related materials marks a significant but cautious step toward trade stabilization with the United States and the European Union.

While the move may temporarily relieve supply pressures for carmakers, experts warn that the underlying tensions surrounding technological sovereignty and national security remain unresolved.

For now, however, global markets are expected to welcome the thaw, viewing it as a potential prelude to broader cooperation in the semiconductor and automotive sectors—two industries vital to the world economy.