Global oil prices soared on Friday after Israel confirmed a significant military operation targeting Iran, sparking fresh concerns over potential disruptions to energy supplies from one of the world’s most vital regions.

Shortly after the news broke, the price of Brent crude—used as the global oil benchmark—climbed more than 10%, reaching its highest level since January. Although prices later eased slightly, Brent was still trading over 5% higher than Thursday’s close, settling around $74.47 per barrel.

The price surge comes amid escalating tensions between Israel and Iran, two regional powers whose direct confrontations raise the risk of broader instability across the Middle East. Traders fear that any prolonged or intensified conflict could hinder oil flows from the region, pushing energy costs higher worldwide.

Crude oil prices have a wide-reaching impact, influencing everything from petrol at the pump to the cost of transporting goods, thereby affecting global food and consumer prices. While Friday’s price spike remains below previous crisis-driven highs, the move is enough to reignite inflationary concerns already troubling many economies.

Despite the sharp rise, Brent crude remains more than 10% cheaper than it was at the same point last year. It also continues to trade significantly below the peaks seen in early 2022 after Russia’s invasion of Ukraine, when prices shot above $100 per barrel.

Markets React: Stocks Fall, Safe Havens Rise

Equity markets across Asia and Europe responded to the news with immediate losses. Japan’s Nikkei index ended the trading day down 0.9%, while London’s FTSE 100 dipped 0.3% by midday. US stock markets also opened in negative territory, with the Dow Jones Industrial Average falling by 1.5% and the S&P 500 dropping 0.8%.

In contrast, so-called “safe haven” assets saw gains as investors rushed to protect their capital. Gold, traditionally viewed as a refuge during geopolitical crises, surged to its highest price in nearly two months—rising 1.2% to $3,423.30 per ounce. The Swiss franc, another preferred safe haven, also strengthened.

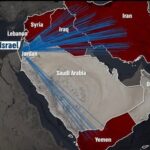

Iran Responds With Drone Offensive

In a sign of swift retaliation, the Israeli Defence Forces (IDF) reported that Iran had launched approximately 100 drones toward Israel following the initial strikes. The development significantly increases the risk of a prolonged military confrontation between the two nations.

Israeli military officials said their operation targeted key nuclear facilities and high-ranking military officials within Iran. The strikes marked a dramatic escalation in hostilities, further heightening fears of a wider regional conflict.

Analysts Warn of Oil Supply Shocks

Speaking to the BBC, Vandana Hari, founder of Vanda Insights, described the situation as “explosive” and noted that while past flare-ups between Israel and Iran had de-escalated quickly, this confrontation could spiral into a broader war with serious consequences for global oil markets.

“There’s a risk that this could disrupt Middle East oil supply significantly,” Hari said.

Analysts at Capital Economics echoed those concerns, stating that if Iranian oil production facilities or export terminals were damaged, Brent crude could soar to between $80 and $100 per barrel. However, they added that such price spikes could trigger a production increase from other oil-producing nations, which might stabilize markets and reduce the inflationary pressure.

Uncertainty Over Impact on Fuel Prices

Rod Dennis, a spokesperson for the UK-based RAC motoring group, said it was still “too soon” to determine the impact the current oil price surge will have on retail petrol and diesel prices.

“There are two key factors at play: whether higher wholesale fuel prices are sustained over the coming days and, crucially, the sort of margin retailers decide to take,” Dennis explained.

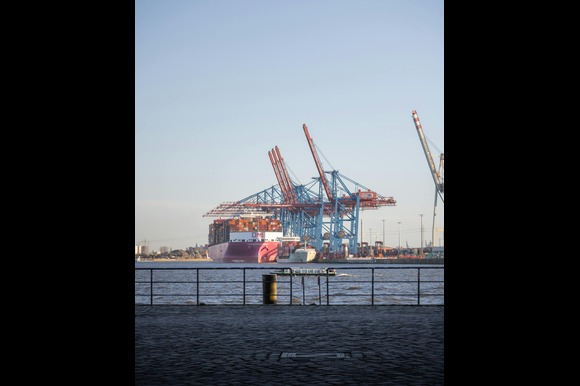

Strategic Chokepoint Under Threat

Analysts are particularly worried about the Strait of Hormuz, a narrow waterway that plays a critical role in global energy supply. Roughly one-fifth of the world’s oil passes through the strait, which sits between Iran to the north and Oman and the UAE to the south.

If Iran decides to retaliate further by disrupting the strait—either through military action or targeting oil tankers—the global supply chain for crude oil could be severely impacted. At any given time, dozens of oil tankers are either entering or exiting this maritime corridor, transporting energy resources to and from the Gulf.

“This is an initial risk-on reaction from the market,” said Saul Kavonic, head of energy research at MST Financial. “But over the next day or two, the market will need to factor in where this could escalate to.”

With tensions running high and the potential for further escalation looming, global markets remain on edge—closely watching for the next move in this fast-developing crisis.