President Donald Trump has announced that the United States will impose a 15% tariff on imports from South Korea, calling it a “full and complete trade deal” just one day before the 1 August deadline for countries to finalise agreements or face steeper duties.

South Korea had been at risk of facing a 25% tariff if a deal had not been secured. The agreement puts Seoul on par with Japan, which reached a similar arrangement with the US last week, easing pressure on South Korea amid fierce competition between the two nations in the automotive and manufacturing sectors.

Under the terms of the deal, South Korea has also committed to invest $350 billion (£264.1 billion) in the US economy, an agreement being celebrated in Seoul as a significant diplomatic and economic success — especially in light of the country’s record $56 billion trade surplus with the US last year.

The 15% tariff will apply to two of South Korea’s most critical exports: automobiles and semiconductors. However, other major export sectors such as steel and aluminium will face a 50% tariff, in line with the global rate established by President Trump.

Despite the steel and aluminium tariffs, South Korean President Lee Jae Myung praised the agreement, saying it places South Korea on equal or more favourable footing compared to other trade partners.

A major win for South Korea in the negotiations was its ability to hold firm on key domestic issues. Seoul refused to further open its agricultural markets — particularly rice and beef — to US imports. The South Korean government maintains strict quotas and regulations on American rice and beef to protect its farming sector. Relaxing these restrictions would have sparked nationwide protests from farmers.

Of the $350 billion pledged, $150 billion will be directed toward revitalising US shipbuilding, including the construction of warships — a critical point in the deal and a strategic move by South Korea. The country has the world’s second-largest shipbuilding industry after China, and by supporting the struggling US naval industry, Seoul strengthens its own industrial base while addressing American security concerns.

The rest of the investment will largely come from previously announced commitments made during the Biden administration that have yet to be fulfilled. These funds will support the development of US-based manufacturing for automobiles, semiconductors, and electric vehicle batteries — industries that remain central to both nations’ economic strategies.

Importantly, the new trade agreement does not affect the US-South Korea military alliance or the American military presence on the Korean Peninsula. However, past threats from President Trump to withdraw US troops unless South Korea pays more for the security arrangement remain a looming issue. South Korean negotiators had considered trying to resolve this matter as part of the current trade talks, but it was deferred.

That unresolved military funding issue is expected to be addressed during President Lee’s upcoming state visit to Washington in two weeks, where he will meet President Trump for a bilateral summit. Analysts believe South Korea may be asked to make another large financial commitment during those discussions.

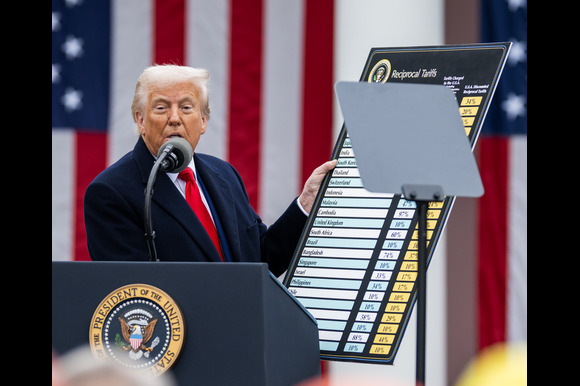

Since returning to office in January, President Trump has introduced a wave of tariffs targeting imports from multiple countries, claiming that these measures are designed to protect American jobs and industries. While he argues that this approach will reinvigorate domestic manufacturing, critics contend that his unpredictable trade policies are destabilising the global economy and driving up costs for American consumers.

The South Korea deal, with its mix of tariff reductions, strategic investment, and unresolved defence spending questions, reflects the complexity and high stakes of the Trump administration’s confrontational trade agenda.